Our commitment to financial strength

Trust starts with financial strength

We're among the strongest.

More people are putting their trust in Northwestern Mutual—which is the ultimate measure of success. Exceptional financial strength means you can count on us to be here when you need us. In 2023, the company thrived despite the year's continuing uncertainty and challenges, generating record operating gain and surplus while maintaining the highest available financial strength ratings awarded to any U.S. life insurer by all of the four major rating agencies.

See our 2023 Annual Report

Trust is the foundation

Trust is the foundation of all successful financial relationships. You need the confidence that we know what we're doing, will honor our commitments, and that you—our client—are our highest priority. To do these things all of the time—free from the pressure to cut corners or from being distracted by financial pressures—means having the resources that only come with financial strength.

Our investment accounts come with automatic protection.

While Northwestern Mutual is one of the strongest companies in America, we also have automatic protection in place for our investments. That's because Northwestern Mutual Investment Services, LLC (NMIS) is a member of Securities Investor Protection Corporation (SIPC). SIPC protects NMIS accounts up to $500,000 (including $250,000 for claims for cash) in the event that a firm fails.

Find out moreWe're established.

In 2024, Northwestern Mutual was again named one of the World's Most Admired Companies® in its industry according to Fortune's annual survey. Additionally, the Fortune 500® ranking is among the most recognized measure of financial success. Being #111 in 2023 affirms that Northwestern Mutual is among America's premier companies.

Financial strength

1

A++ A.M. Best Company rating

HighestA.M. Best CompanyAugust 2023

Ratings Analysis Report

AAA Fitch Ratings rating

HighestFitch RatingsAugust 2023

Ratings Analysis Report

Aaa Moody's Investors Service rating

HighestMoody's Investors ServiceNovember 2023

Ratings Analysis Report

AA+ Moody's Investors Service rating

Highest AvailableS&P Global Ratings2May 2023

Ratings Analysis Report

Our Results

Annual Statements

2023 Annual Statements

Statutory Quarterly Statements for Northwestern Mutual Life Insurance Company

2023 Quarterly Statements

Statutory Quarterly Statements for Northwestern Long Term Care Insurance Company

2023 Quarterly Statements

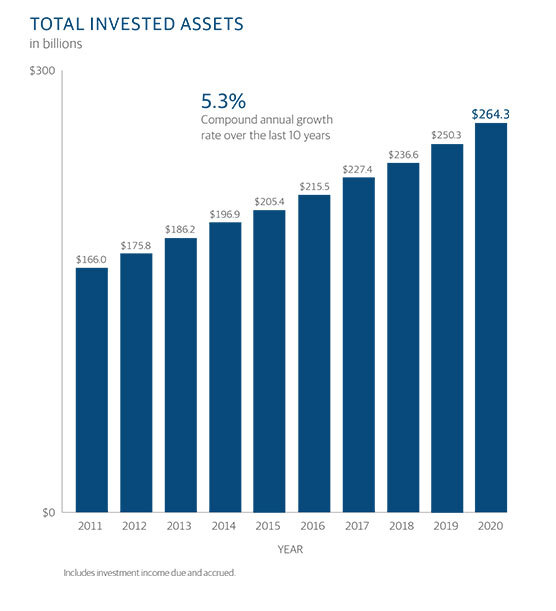

Backing our strength—Northwestern Mutual's investment portfolio

Total invested assets

Bar chart showing total invested assets and the 5.3 percent compound annual growth rate over the last ten years.

Values

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| 166.0 billion dollars | 175.8 billion dollars | 186.2 billion dollars | 196.9 billion dollars | 205.4 billion dollars | 215.5 billion dollars | 227.4 billion dollars | 236.6 billion dollars | 250.3 billion dollars | 264.3 billion dollars |

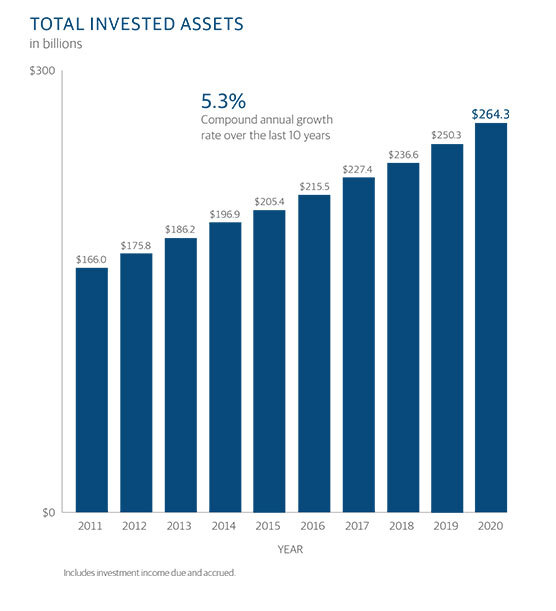

Northwestern Mutual invests the majority of its assets through the General Account, the company's $260 billion+ portfolio. The portfolio has grown consistently year after year. By buying life insurance, disability insurance and deferred annuities, clients immediately gain the opportunity to share in the company's favorable results.

Total invested assets

Bar chart showing total invested assets and the 5.3 percent compound annual growth rate over the last ten years.

Values

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| 166.0 billion dollars | 175.8 billion dollars | 186.2 billion dollars | 196.9 billion dollars | 205.4 billion dollars | 215.5 billion dollars | 227.4 billion dollars | 236.6 billion dollars | 250.3 billion dollars | 264.3 billion dollars |

Detailed listing of Northwestern Mutual Life Insurance Company's investment holdings

(As of )

We put clients first.

"We succeed when you succeed." For more than 160 years, we've been an industry leader by holding true to this simple principle. By managing our business effectively and acting in the best Long-Term interest of our clients, we're able to offer excellent product value and service for a lifetime of financial security.