Bringing Retirement Dreams To Life

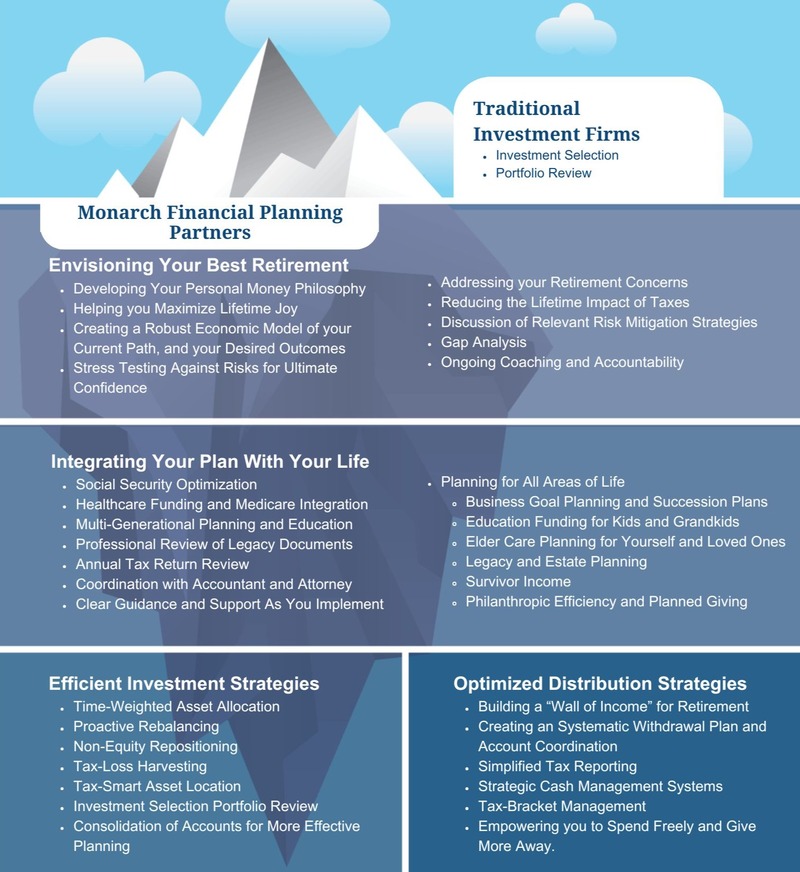

Monarch Financial Planning Partners

Tom Morris

Principal and Co-Founder|CFP®, MBA, RICP®, WMCP®, CASL®

Creating An Antifragile Plan

We focus exclusively on clients in or near retirement, priding ourselves on adding tangible value through:

-

- reducing expenses

- adding tax efficiencies

- providing financial guidance

- keeping you on an even keel, and

- helping you find the joy

More specifically, consider that although many financial advisors are competent at helping you with accumulation strategies, implementing a retirement distribution plan is a horse of another color. Which asset do you liquidate first, second, or third, and why? What if, and what if, and what if?

You're the captain of your family's ship. You have tasks to assign, shoals to navigate, course corrections to plot. It's a big job, but you're already smart, savvy, and successful or we wouldn't be having this conversation: you undoubtedly have asset management, risk management, and tax management "divisions" on board.

It's a large enterprise and a long trip. An external audit can help make sure all departments are running cooperatively, without gaps or overlaps. Further, as you near that unexplored continent called retirement, it's important to view it from every angle. Is your strategy best suited to get you where you want to go as you enter your "decumulation phase"?

One question: when was the last time someone besides you stood on the bridge and saw the whole thing in one place?

We're planners. We observe deeply and report back to you comprehensively about what you're doing that's really well-aligned, often finding areas for your further consideration. There might be strategic finesses you didn't know about, untrumpeted fragilities, hidden risks, surprising opportunities.

Our fee for planning is determined by the individual. The goal is to get to a number that is reasonable for our clients in terms of cost, and reflective of the value they receive working with us.

You can expect from an engagement with us:

- a comprehensive analysis of your full financial picture,

- a roadmap of where you want to go and detailed implementation plan to get there,

- one major revision to the roadmap,

- one full year of consulting/call-for-any-reason starting from the date of your discovery meeting,

- access to special client events and activities,

- For those who renew annually, a seasonal service calendar with deep dive topics according to individual needs and interests.

All investments carry some level of risk, including loss of principal invested.

|

Wait...An Anti-fragile Plan? What Does That Mean?

Anti-fragility refers to a system so flexible that it actually gets better under stress. Think of Hydra, the many-headed serpent that Hercules faced: every time one head was cut off, two others grew in its place. The Hydra was an anti-fragile monster.

Wouldn't you want your financial plan to be antifragile, too? --that is, no matter how rough the waters around you, your plan not only survives, but thrives. Like a diamond that forms under pressure, or a basketball-which when thrown to the ground bounces back up, it's possible to create a retirement strategy that can flourish, no matter what might be happening in the world around you.

The first step in shifting toward an anti-fragile plan is setting up a convenient time to get together so Tom can learn a little bit about you, you can learn a little bit more about him, and together you can determine whether and how he can help.