A legacy of excellence

2023 Annual Report

Message from CEO John E. Schlifske

No one does mutuality like Northwestern Mutual

Mutuality means we run the company focused on a single priority: you. In 2023, a year of headlines that emphasized our world's uncertainty—economically, geopolitically, and technologically—Northwestern Mutual was once again a source of financial stability and value for policyowners. Our unwavering strength—unsurpassed in our industry—is more relevant now than ever.

That's why I'm happy to report that 2023 continued the exceptional business performance that has made this the best era in our company's history—success that is earned for you.

For 2024, we announced our highest dividend interest rate increase in over 25 years—to 5.15 percent—and an expected total payout of $7.3 billion—another historic high for Northwestern Mutual and over three times our closest competitor.

Our business is evolving with your needs to keep ensuring that, in all economic environments, you have complete confidence in our ability to support you and your family throughout your financial lives. Last year, more clients than ever partnered with their advisors* on a comprehensive plan.

At the end of 2024 I will retire, and President and 22-year Northwestern Mutual veteran Tim Gerend will assume the role of CEO. Just like my predecessors before me, one consideration has driven all our decisions in my 14 years as CEO: doing what's best for our policyowners. As I've often said, no one does mutuality like Northwestern Mutual. The strong results you'll read about in this report matter because they're proof we're upholding our mutual commitment to you.

Nearly 40 years here have left me with absolutely no doubt that these values will continue to guide this extraordinary company to new heights under Tim's leadership. Thank you for your trust in Northwestern Mutual.

John E. Schlifske

Chairman and Chief Executive Officer

No company is better positioned to help you plan than Northwestern Mutual.

It's never been a better time to be a policyowner

Looking back, our results since 2020 have exceeded all prior years. Looking forward, we believe no other company in the industry is better positioned for future growth and prosperity. Our financial strength is unsurpassed, and the growth and productivity of our field of financial professionals are outstanding.

In 2023, we accelerated progress on Northwestern Mutual's unique "protect and prosper" solutions. Thus far, the financial industry has treated protecting against risks and growing wealth as disconnected needs. Instead, our solutions integrate insurance and investments in tailored plans that reinforce the advantages of both. We developed these plans seeking to at once simplify your financial life—making it easier to manage and control—and deliver superior long-term outcomes.

You can always count on Northwestern Mutual to take the long-term view that makes your financial life better.

97%

of policyowners stay with us year after year.**

Unsurpassed financial strength

Exceptional financial strength means you can count on us to be here when you need us. We yet again maintained the highest available financial strength ratings awarded to any U.S. life insurer by all of the four major rating agencies.1

Aaa Moody's Investors Service rating

HighestMoody's RatingsAugust 2024

A++ A.M. Best Company rating

HighestA.M. Best CompanyAugust 2023

AAA Fitch Ratings rating

HighestFitch RatingsJuly 2024

AA+ Moody's Investors Service rating

Highest AvailableS&P Global Ratings2April 2024

2023 financial results:

Another exceptional yearIn 2023, Northwestern Mutual's mission to help more Americans build financial security was bolstered by its highest-ever dividend payout, historic growth in its field of financial representatives, the rapid expansion of its wealth management business, strong investment performance, and transformative client experience investments. The company thrived despite the year's continuing uncertainty and challenges, generating record operating gain and surplus while maintaining the highest level of financial strength in the industry.

Highest total surplus

Surplus is the amount of capital we hold over and above our policyowner benefit reserves to cover the unexpected. When challenges arise, a strong surplus level helps ensure we will be here for the long term, paying policyowner benefits and preserving product value. It also gives us the flexibility to proactively manage the company with a long-term view and take advantage of potentially higher-yielding investments while maintaining the industry's highest financial strength ratings. In 2023, solid fundamentals supported by favorable equity markets resulted in an all-time high total surplus of more than $38 billion.3

The industry's largest dividend payout4

Every year, we aim to pay the highest possible dividends while maintaining unquestionable long-term financial strength, in a manner guided by mutuality. Supported by an exceptional surplus position and excellent operating fundamentals, we expect to provide a record $7.3 billion dividend payout in 2024, $550 million more than our 2023 dividend award. We will once again lead the industry in total dividends paid to life insurance and disability insurance policyowners by a wide margin.

America's largest life insurer

Northwestern Mutual is the largest direct provider of individual life insurance in the United States5—covering the needs of millions of policyowners like you—and our total life insurance protection in place now stands at an impressive $2.3 trillion. Permanent life insurance premium sales continue to be historically strong, resulting in a five-year compound annual growth rate (CAGR) over 8%. Additionally, 97% of policyowners maintained their life insurance coverage in 2023.** This growth and persistency benefit our current policyowners by lowering per-policy costs and allowing us to focus on long-term investments that can produce stronger returns.

Rising investments leader

Northwestern Mutual is a top 5 independent broker-dealer by revenue and among the fastest growing in the U.S.6 In 2023, favorable equity market conditions contributed to a 24% increase in total client investment assets, finishing the year at its highest-ever level of $281 billion. Sales of nearly $50 billion by the company's retail investment business is an all-time high, resulting in annual net cash flow of $22 billion and proof that people are turning to Northwestern Mutual advisors to both manage their wealth and protect against risk.

Building a better tomorrow through sustainability and social impact

Our business is built on the belief that when you do what's right, success follows. Guided by our mutual values, we integrate sustainability, social responsibility, and good governance practices into our business operations for long-term value creation and positive societal impact. To create a better tomorrow for our employees, financial advisors and representatives, our clients, and the communities we serve, we focus efforts on: delivering financial security and expanding financial access; strengthening our culture of belonging; investing in our communities; and reducing our environmental impact. Learn about this important work in our 2023 Sustainability and Social Impact report.

Spotlight: Investing in our communities

Through the Northwestern Mutual Foundation, we are committed to accelerating the search for better treatments and cures for childhood cancer and reducing the financial burden cancer treatment has on families. In our hometown of Milwaukee, we're helping to expand access to quality education, revitalize underserved neighborhoods, increase opportunities for home ownership, and support premier cultural attractions—helping drive transformational and sustainable community outcomes.

$50M+ donated to fight childhood cancer and support children and families since 2012

donated to fight childhood cancer and support children and families since 2012

$60M+ invested in Milwaukee area students over twenty five plus years

invested in Milwaukee-area students over 25+ years

$15M+ invested in revitalizing underserved Milwaukee neighborhoods since 2013

invested in revitalizing underserved Milwaukee neighborhoods since 2013

Access your online account

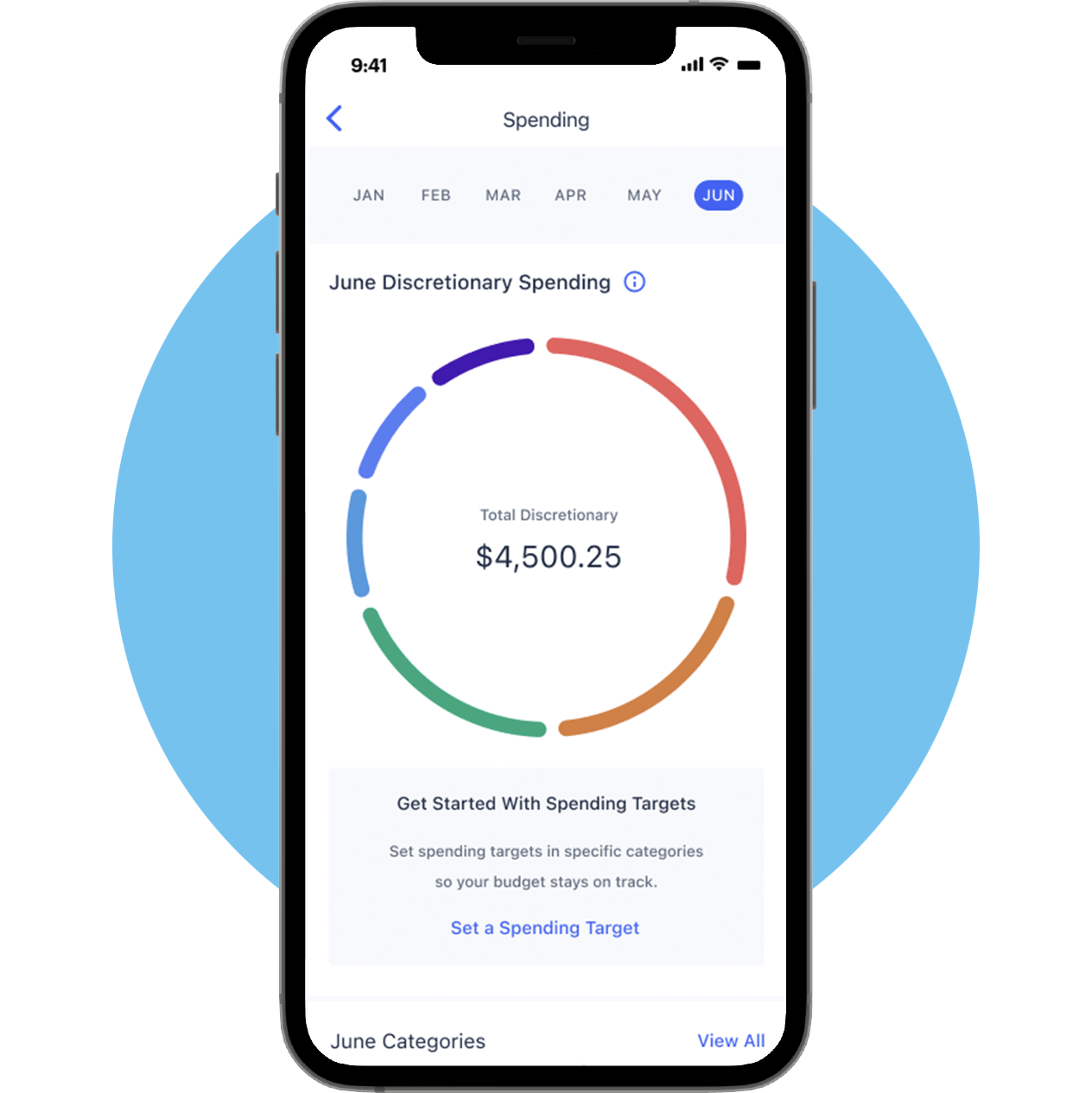

It's never been easier to stay on top of your finances, all in one place. View policy and investment details, add beneficiaries, make a payment, know what you're spending (and where), and so much more. Access your account today—via the web or our mobile app.