A better way to money®

2024 Annual Report

Message from CEO Timothy J. Gerend

Purpose-driven

This is my first annual report since becoming CEO of Northwestern Mutual. To me, the annual report has always underscored our purpose. Sharing the company's progress and performance is a yearly affirmation of how we put you, our policyowners, first.

In 2024, we again demonstrated that resolve to always do what's best for policyowners by delivering the superior value you expect from us. Supported by the year's robust financial performance, we announced the largest increase in total dividend payout in company history. That makes this year's anticipated dividend payout another Northwestern Mutual record that's more than three times our closest competitor.

Importantly, our thorough long-term financial management made sure 2025's historic dividend payout won't come at the cost of tomorrow's dividends or our superior financial strength. 2024 was our 34th consecutive year of unsurpassed financial strength ratings, which will support more industry-leading dividends and our commitments to be there for you into the future.

That future has never been brighter. We're developing innovative solutions we call A Better Way to Money because all apply a unique approach to growing and protecting money guided by a single aim—the best possible outcome for every client. This begins with you partnering with an expert advisor* on your path to financial security. Together, you'll create a personalized financial plan using the best of insurance and investments in a way you won't find elsewhere in financial services. Northwestern Mutual is committed to financial planning that keeps you in control no matter what the future holds—that's what it means to always do what's right for our clients.

I am deeply grateful for the opportunity to lead a purpose-driven company that thinks long term, puts policyowners first, and defines success by bettering your financial lives.

Thank you for placing your trust in Northwestern Mutual. We'll continue to work hard every day to earn it.

Timothy J. Gerend

Chairman, President, and Chief Executive Officer

A Better Way to Money®

At Northwestern Mutual, we have a totally different approach to money. It starts with better conversations and expert advisors who listen closely, act with empathy, lead with experience, and help free Americans from financial anxiety with tailored solutions available nowhere else.

As a policyowner, you're more than a client. We're a mutual company, which means we don't have shareholders and operate for the benefit of our policyowners. In other words, we're in the business of shared success.

Money is more than a policy or portfolio. Together we'll discover what it means to you. Take a straighter route through the complexity. Reveal the opportunities and blind spots others often miss.

And we know that when you take action to protect your money while you grow it, you're more likely to have better outcomes and stability. So, yes, our planning is different, which is why our success is different.

The way we see it, our unique perspective, exclusive solutions, and a nearly 170-year commitment to always act in the best interest of our clients—that's a better way to money.

Focused on financial strength

Northwestern Mutual's exceptional financial strength is externally validated by all four major rating agencies. In 2024, we yet again maintained their highest available financial strength ratings awarded to any U.S. life insurer.1

Aa1 Moody's Investors Service rating

Second HighestMoody's RatingsJune 2025

A++ A.M. Best Company rating

HighestA.M. Best CompanyOctober 2024

AAA Fitch Ratings rating

HighestFitch RatingsJuly 2025

AA+ Moody's Investors Service rating

Second HighestS&P Global Ratings2April 2024

Focused on product value

2024 financial resultsSuperior product value is among the most important ways we deliver on the promise of mutuality for you, our policyowners. In 2024, thanks to superior investment performance, disciplined financial and expense management, and strong fundamentals, Northwestern Mutual was able to powerfully demonstrate its commitment to product value with the announcement of yet another record dividend. The company also ended the year with a record surplus, sustaining the unsurpassed financial strength that supports our claims-paying ability when you need us.

All-time high total surplus

Surplus is capital we hold above policyowner benefit reserves to cover the unexpected. When challenges arise, a strong surplus helps ensure we will be here for the long term, paying policyowner benefits and preserving product value. It enables us to take a proactive, long-term approach to managing the company and pursue potentially higher-yielding investments while maintaining the industry's highest financial strength ratings. In 2024, excellent fundamentals supported by favorable equity markets resulted in an all-time high total surplus of more than $40 billion,3 even after declaring $885 million more in dividends than the prior year.

The industry's largest dividend payout4

Every year, we aim to pay the highest possible dividends while maintaining unquestionable long-term financial strength, in a manner guided by mutuality. Supported by an exceptional surplus position and excellent operating fundamentals, we expect to provide a record dividend payout of more than $8.2 billion in 2025, $885 million more than our 2024 dividend payout. We will once again lead the industry in total dividends paid to life insurance and disability insurance policyowners by a wide margin.

America's largest life insurer

Northwestern Mutual is the largest direct provider of individual life insurance in the United States5—covering the needs of millions of policyowners like you—and, impressively, our total life insurance protection in place is nearly $2.4 trillion. Permanent life insurance premium sales have been strong over the past five years, resulting in a compound annual growth rate (CAGR) over 4%. Additionally, 97% of policyowners maintained their life insurance coverage in 2024.6

Rising retail investments leader

Northwestern Mutual is a top-five independent broker-dealer by revenue and among the fastest growing in the U.S.7 In 2024, sales by the company's retail investment business reached a record $59.3 billion, resulting in annual net cash flow of nearly $22 billion and proof that people are turning to Northwestern Mutual's expert advisors to both manage their wealth and protect against risk. This strong net cash flow and favorable equity market conditions contributed to a 19% increase in total client investment assets, finishing the year at its highest-ever level, nearly $335 billion.

Building a better way to tomorrow

As a mutual company with a mission to improve lives through financial security, we focus on actions today that shape a better tomorrow. Our sustainability and impact efforts play a critical role in protecting our financial strength, elevating business operations, driving positive economic outcomes, and ensuring we remain relevant and well positioned to grow policyowner value and serve future generations.

Spotlight: Investing in our communities

To create a better way to tomorrow for our people, our clients, and the communities we serve, we invest in transformational and sustainable community outcomes that help improve lives. Through the Northwestern Mutual Foundation, we are committed to accelerating the search for better treatments and cures for childhood cancer and reducing the financial burden cancer treatment has on families. In our hometown of Milwaukee, we're helping to expand access to quality education, revitalize underserved neighborhoods, increase opportunities for home ownership, and support premier cultural attractions.

$500M+ donated to nonprofits through the Northwestern Mutual Foundation since its inception in 1992

donated to nonprofits through the Northwestern Mutual Foundation since its inception in 1992

810K+ hours of research funded since 2012 to accelerate the search for better treatments and cures for childhood cancer

hours of research funded since 2012 to accelerate the search for better treatments and cures for childhood cancer

20K+ early childhood, K-12, and higher-education students supported in Milwaukee in 2024

early childhood, K-12, and higher-education students supported in Milwaukee in 2024

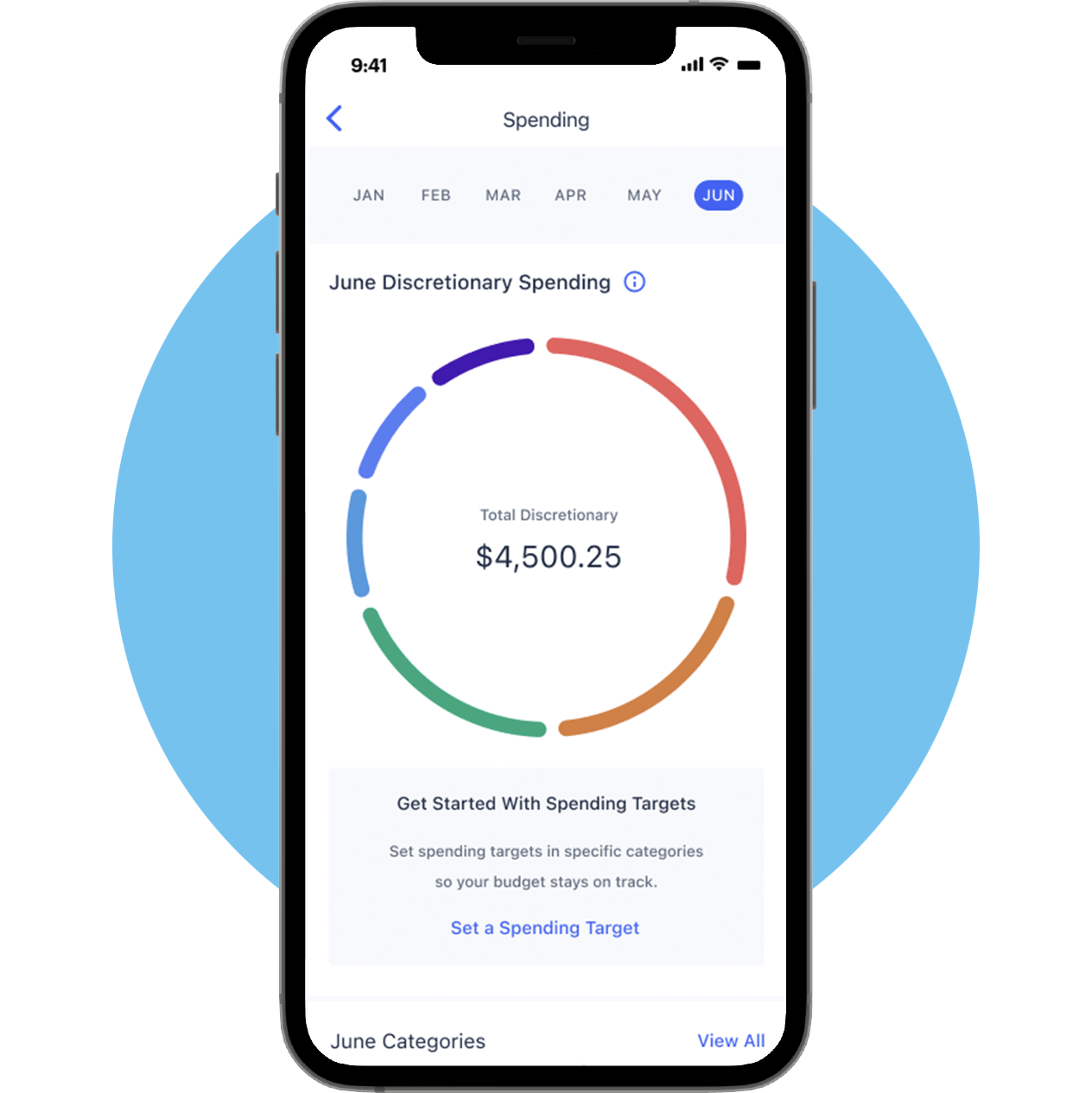

Access your online account

It's never been easier to stay on top of your finances, all in one place. View policy and investment details, add beneficiaries, make a payment, know what you're spending (and where), and so much more. Access your account today—via the web or our mobile app.