article

The Financial Steps to Take Before Applying for a Mortgage

Learn more

Taking the leap from renter to homeowner is one of the biggest financial decisions you'll ever make. Your Northwestern Mutual advisor is here to help with things like figuring out what you can afford, learning about various "hidden costs," or finding a down payment in unexpected places.

A down payment and mortgage analysis are just a couple ways we'll help you get into your dream home.

More about how we planThere's more to life insurance than you might think. Besides helping to protect your family's financial future, you can use your whole life policy's cash value for "life things" like putting a down payment on your house or adding a room as your family grows.1 Life insurance is one of the best ways to make sure your loved ones can stay in your home, even if you're not around to pay the mortgage. We'll help you get the right coverage, without paying for anything you don't want or need.

More about life insuranceYour income is essential to paying your mortgage, so protect your biggest asset—your earning potential—and help pay your bills if you can't work. We'll help you find the best way to protect your family's livelihood, and keep some household expenses covered, should something unexpected happen.2

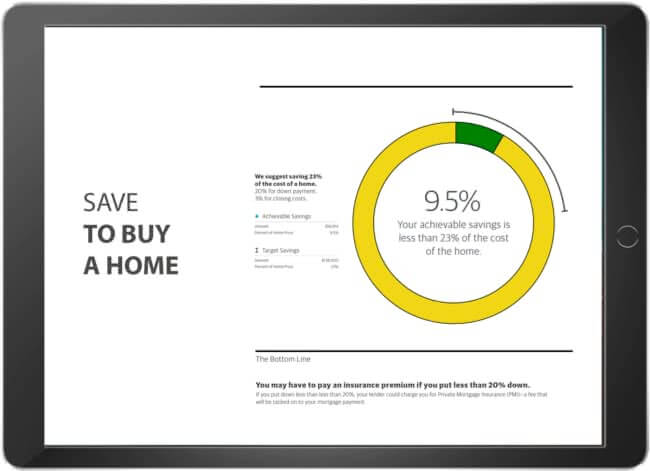

More about disability insuranceIf you put less than 20% down on your new home, you could get an insurance fee tacked on to your mortgage payment.

Our financial advisors can design a personalized plan to help get you into the home of your dreams. Then get to your next goal. And the next.

It's easy to get started—no commitment, just a better conversation.