Strong Economy Can Carry Market Through Uncertain Times

Investor sentiment right now is remarkably low, but we see several positive undercurrents that should pull markets through this tough stretch atop continued growth.

- Asset Allocation

- Mar 09, 2022

Northwestern Mutual Wealth Management Company’s (NMWMC) investment professionals provide views and commentary on the current marketplace. This information is designed as general commentary regarding our asset class views and asset allocation strategy at a given time.

The strategic viewpoints represented in the article below illustrate our views on the relative attractiveness of different asset classes over the next 12 to 18 months. Keep in mind that this viewpoint can and will change as valuations and economic variables evolve. While our views are reflected in the portfolios managed by Northwestern Mutual Wealth Management Company, they are not a general recommendation for individual investors. These views made in the context of a well-diversified portfolio, not in isolation. Decisions about investments should always be done on an individual basis or in consultation with a financial advisor, based on an individual’s preferred risk levels and long-term goals.

Inside Our March 2022 Asset Allocation Focus

Jump to section

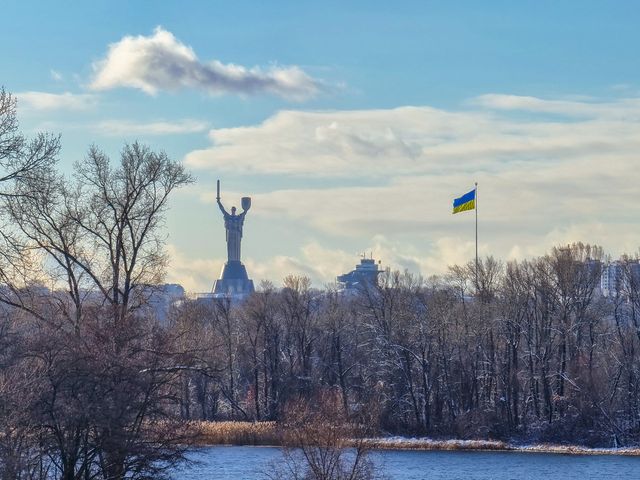

Section 01 Introduction: Inflation, the Fed and War in Ukraine

Over the past few weeks, investors concerned about inflation and the Federal Reserve were forced to confront another variable as Russia invaded Ukraine. Weary investors responded by selling and pushed the market deeper into correction territory (down 10 percent from previous peaks). This marks the 25th time since 1950 that stocks have fallen by more than 10 percent.

We remind investors that markets tend to quickly recover losses after a correction and reach new highs, especially when an economic recession hasn’t occurred. Simply put, equity markets are eventually pulled higher by continued economic growth. Our research reveals that in 11 of the previous 24 market corrections of 10 percent or more since 1950, markets recaptured losses and made new highs within eight months or less. Also consider that within the 72-year time frame we analyzed, the economy grappled with bouts of inflation, deflation, political and economic crises, Fed tightening cycles and, sadly, numerous geopolitical conflicts and wars.

The outcome of the Ukraine and Russia war is uncertain. History suggests markets react sharply to the shock of the event but settle and move higher as expectations recalibrate to the new geopolitical environment. While both Russia and Ukraine are small economically, they both play a role in the world’s commodity markets. Russia is the third-largest oil producer (behind the United States and Saudi Arabi) and the second largest natural gas producer behind the United States. Ukraine, on the other hand, is a major exporter of wheat. As a result, the price of oil, natural gas and some agricultural commodities will likely rise. Higher prices will be felt particularly in places like Europe, where 40 percent of natural gas supplies come from Russia. Sweeping economic sanctions imposed by the West on Russia could have spillover effects on global economic growth, as well.

No one knows for certain how this war will play out or the human devastation it will inflict. The good news, from a purely financial perspective, is economies around the globe are seeing COVID-19-related impacts decline, and economic growth remains strong, especially in the U.S. Rising energy prices could complicate the inflationary backdrop, but the U.S. economy continues to normalize to its pre-COVID trends, which we believe will serve as a sizable disinflationary force. Those concerned about energy costs would do well to remember the U.S. is a large energy producer itself.

Despite rising uncertainty and risks, our base case continues to be that the U.S. economy is healthy enough to grind higher in 2022, albeit at a slightly reduced pace. Eventually the economy will pull markets higher as well.

The market is a discounting mechanism of the future

Share of investors who are "bullish", based on the AAII survey from Feb. 16, 2022.

While risks feel like they’re at a boiling point, the reality is markets are a hyper-efficient discounting mechanism of future events, which means much uncertainty or pessimism has already been priced in. While headlines will fuel a volatile ride, many investors have already discounted much negativity.

The American Association of Individual Investor Sentiment Survey (AAII), which has been conducted weekly since 1987, asks 1,000 individual investors one simple question: What direction do you feel the stock market will go in the next six months? Over the past few weeks this survey has reflected near-record levels of negativity. For example, the survey results from the week of Feb. 16 showed that only 19.2 percent of respondents were bullish. A review of history shows that of 1,804 prior survey weeks, this number has been lower only 27 other times.

Think about all the events that have occurred since 1987, when the AAII survey began. In every one of those 27 periods of deep pessimism, the S&P 500 posted positive returns within the coming 52 weeks. This one variable does not guarantee this outcome will occur again, but the numbers support the old Wall Street adage “climbing the wall of worry.” It’s why we continually remind investors not to act upon their emotions. Sentiment is a contrarian indicator, and those who stick through the tough times are often rewarded with future gains.

Current economic growth remains robust

Leading economic indicators continue to point to a U.S. economy that retains momentum. The six- month annualized rate of change of the Conference Board’s 10 leading indicators resides at 5.2 percent. Putting this into historical context, since 1960 the U.S. economy has endured nine recessions, and seven of these began when this indicator dipped into negative territory. The two that didn’t were the recession that began in April 1960 and the recent COVID-19 recession that began in February 2020 (when this number was at 0.2 percent). However, we note that in each one of these, this indicator was negative in the months prior.

We’d also note that U.S. consumer balance sheets and income statements remain solid. Current debt-to-asset levels are at 12 percent versus a peak of 24 percent in early 2009. Monthly expenses relative to disposable personal income are at 13.8 percent versus 18 percent during the same period (2009 vs. today). The most likely impact of the Ukraine-Russia war will be rising energy prices, which may dampen consumption and economic growth. However, we believe it’s important to place these risks into the context of an otherwise relatively strong economic backdrop.

Ready to turn your dreams into a financial plan?

Our advisors will walk you through what to do next — and will be there every step of the way.

Let's talkNo doubt, consumer balance sheets were bolstered by enhanced COVID-19 stimulus and rising asset prices that are now waning. But there’s a silver lining: A return to economic normalcy that we have written about for some time may indeed already be underway. The U.S. economy and consumer may be returning to pre-COVID spending trends, which we believe will cause inflation to peak and roll over, even with a backdrop of rising commodity prices.

Inflation remains a “goods” thing

Inflation has been in large part the result of pandemic-constrained supply against a backdrop of stimulus-fueled demand as well as a massive “spend shift” that favored goods over services. These inflationary pressures began one year ago in March 2021. Recall that in February 2021 inflation (PCE) resided at a meager 1.6 percent year over year. Back then, we were warning that leading indicators of inflation were pointing higher. Contrast that to today, when inflation resides at 6.1 percent year over year. Now we are beginning to see leading inflation indicators pointing to a peak. Pressures will quickly dissipate as COVID-19 continues to lessen its grip on the U.S. and global economy.

This pandemic-related consumer demand shift has resulted in goods spending that is 16.9 percent higher on a real basis from where it was in February 2020, while services spending is still 1 percent lower than it was on that same date. This “shifted” spending occurred against a backdrop of pandemic constrained inventories and supply chain bottlenecks. The result has been a spike in goods inflation, which as of January was up 8.8 percent year over year. Contrast this to the previous economic cycle (2009-2020), when overall goods inflation was flat. Going one level deeper reveals where stresses have been the most acute and “historically odd.” Durable goods prices (think sporting equipment, appliances, furniture) are up 11.6 percent year over year. Contrast that with the prior 25-year deflationary time frame. We believe this is a one-time price spike tied to a pandemic, not a new intermediate- or long-term economic reality.

Overall, consumer spending will moderate in 2022, and a larger share of wallet will shift back toward services. Meantime, inventories will continue to rise and satisfy demand. That should lead to falling — if not outright deflationary — goods prices. The data suggest this trend is already underway with goods spending slowing; as of the end of January, goods spending is up 3.6 percent year over year, while durable goods are up only 2.1 percent year over year. COVID-19 remains a wildcard, but current cases are plummeting in the U.S and abroad, and consumers are returning to public areas, spurring that shift back to services sectors.

Data from OpenTable, an online reservation service, indicate seated diners have recently moved sharply higher. As of the beginning of March, reservations are 4 percent higher (seven-day average) than the same period in 2019. Contrast this recovery with data from mid-January, when omicron was raging, and reservations were nearly 30 percent below 2019 levels. Travel is also picking up. These are smaller segments of services sector spending but are indicative of a shift away from goods spending. Housing prices will put upward pressure on inflation in 2022, but they should moderate as the year progresses and mortgage rates increase.

The nimble Federal Reserve

The current market correction began as a recalibration to a much less accommodative monetary and fiscal environment. In early October 2021, the market was pricing in a single, 25-basis-point rate hike from the Fed in 2022. By yearend that rose to three 25-basis-point hikes, and in early to mid-February this had spiked to nearly seven rate hikes totaling 1.75 percent cumulatively. These upward revisions initially impacted growth stocks (whose earnings are more sensitive to rising rates), but the addition of the Ukraine-Russia war has spread the volatility broadly to all stocks. As of this writing the market is pricing in six 25-basis-point hikes in 2022 — but that could certainly change, as we’ve seen.

The recent 5-year, 5-year forward breakeven rate, a proxy for the market's intermediate-term inflation expectations.

The market is worried the Fed will miscalibrate and over-tighten the economy into a recession due to continued inflation pressures. The inflation equation is now more complicated considering Russia's invasion of Ukraine, which has triggered price spikes in several commodities, particularly oil and gas. Still, the Fed’s overarching goal is not to tighten the U.S. economy into a recession but to simply fine-tune policy today so the economy can keep pushing forward in the coming years and draw more Americans back into the labor market. This Fed does not want to unwind the jobs progress it has made over the past few years. With the uncertainty of war denting confidence, the Fed is unlikely to raise rates aggressively.

Supply and demand dynamics should allow the Fed to follow a gradual path, but it also helps that intermediate-term inflation expectations remain anchored — this is important. Temporary inflation can become entrenched if economic agents believe they need to adjust their future behavior for lasting inflation. Today’s levels of inflation are like those of the early 1980s, but back then Americans believed that inflation was a permanent reality. Fed Chair Paul Volcker had to intentionally overtighten the U.S. economy into a recession to stamp out these stubborn inflationary expectations. Currently, this is not the case. Inflation breakevens were falling prior to the Russian invasion. They've now ticked higher, but they remain anchored in the intermediate term. The five-year, five-year forward breakeven resides at 2.38 percent. Put differently, the market believes that five years from now, the five-year breakeven rate will be 2.38 percent. This is not significantly different than the Fed’s 2 percent target and is a sign that markets aren’t expecting permanent inflation, as they did in the 1980s.

We remind investors that this Fed has pivoted policy before by “listening to the market.” In 2018, the Fed forecast three rate hikes in 2019 but it quickly pivoted and cut rates three times. It didn’t do this because its economic forecast changed but because the Fed was “listening to the market” and did not like the inverted Treasury yield curve or precipitous decline in equity markets.

Regardless, the Fed will tighten in 2022, and this certainly has — and will — impact markets both here and abroad. However, our review of history suggests volatility is most acute in the immediate months before and after the first rate hike. Given our forecast of gradual tightening and a Fed committed to avoiding recession, we believe that this current cycle will play out much as past cycles did, with markets rising over the coming quarters.

Putting the mosaic together

Geopolitical risks historically have produced a sharp initial impact as the world reacts to the new realities. However, absent a significant escalation, we tend to see steadying markets as investors recalibrate to the new geopolitical order. We will continue to weigh this new variable into our overall economic and market mosaic and review each asset class and the impact this presents for it.

Since the war began, U.S. equities have held up well relative to their international and eurozone counterparts. Think of this primarily through the lens of the relative dependency on Russia and Ukraine energy: the U.S. has minimal reliance, while Europe is heavily exposed.

Section 02 Current Positioning

In June 2020, we scaled back our equity exposure from a near-maximum overweight position to slightly overweight due to concerns about elevated volatility on the horizon and the stage of the current economic cycle. We also tilted our portfolios away from what we thought were the most expensive market segments, which are most vulnerable to any market downturn. Despite the spread to other market segments, our positioning has proven accurate, as the downside has been most extreme in the priciest stocks.

Inflation risks have likely been enhanced on the back of rising energy prices, but we continue to forecast economic growth and a return to a more normal spending environment in 2022. In February 2022, consistent with our falling inflation outlook, we decided to eliminate a majority of our Treasury Inflation Protection Securities (TIPS) that we bought in late 2019 and again in mid-2020. When we purchased TIPS, the commonly held belief was that inflation was a permanent relic of the past. We disagreed and acted. Now we have heightened levels of inflation, but our forward outlook points to moderating price pressures, which would diminish future TIPS returns relative to other Fixed Income instruments.

Within our U.S. allocation we remain overweight U.S. Small Caps based upon their attractive valuation and potential future earnings growth. The same rings true with our tilt toward value stocks. We retain our one U.S. underweight to Real Estate Investment Trusts (REITs), an asset class that is sensitive to higher interest rates.

Within our international exposure, we reallocated capital from inflation- and rate-sensitive Emerging Markets toward International Developed stocks in June 2021. Our International Developed exposure has been tilted toward the eurozone. While we acknowledged the geopolitical risks Europe was facing from a potential war at the time, we believed cheap valuations, rising economic growth and a central bank that was set to remain accommodative outweighed the potential impacts of war in the region. Over the past two weeks, war has moved from a potential to reality, and we are currently reassessing our eurozone tilt.

Overall, we remain overweight equities versus fixed income, as we believe markets will claw back into positive territory in 2022, while fixed income markets will continue to tread water.

Section 03 Equities

U.S. Large Cap

The start of 2022 marked a sharp reversal in investor sentiment contributing to a correction in the S&P 500. Souring the mood are rising geopolitical tensions, persistent inflationary pressures and the concern of a more hawkish Fed rate cycle. When uncertainty rises, investors historically move up the quality spectrum, which tends to favor U.S. Large Caps on a relative basis. So far, that hasn’t been the case this year. U.S. Large Caps are underperforming their U.S. Mid-Cap and U.S. Small Cap peers year to date, and we think the reason is simply based on valuation. Even with the correction and year-to-date underperformance, the relative valuation remains unattractive; and when liquidity conditions tighten, there simply isn’t a lot of investor tolerance for highly valued assets versus cheaper alternatives, all else being equal. We believe this statement is further magnified in the relative performance of value stocks versus growth stocks. Overall, we remain neutral U.S. Large Cap with a value-style tilt in our implementation.

U.S. Mid-Cap

As volatility has risen to start 2022, U.S. Mid-Caps have been average performers in the equity universe, which is respectable given the higher level of cyclicality that smaller and mid-sized companies tend to have versus larger firms. We’re neutral toward this asset class after closing out an overweight position in the summer of 2021 as a means of reducing our overall equity exposure. We note that the relative valuation of U.S. Mid-Caps remains attractive but not quite as appealing as some other equity asset classes, where our portfolios have excess allocations.

U.S. Small Cap

We retain our positive view toward U.S. Small Caps (represented by the S&P 600 Index). Outside of shifting sentiment levels, the story here hasn’t changed much since our last Asset Allocation Focus. Despite modest outperformance year to date relative to U.S. Large Caps, the relative valuation for U.S. Small Caps continues to hover near dot.com-era levels. Furthermore, we can argue that absolute valuation is also favorable. Small caps trade at just 14.5 times 2022 estimated earnings and 13.1 times 2023 estimated earnings. That’s about five “turns” cheaper than U.S. Large Caps on time estimates and 500-plus basis points above the U.S. 10-year Treasury from a yield perspective.

The risk is that smaller company earnings are the most sensitive to economic conditions, which means if there were a significant economic slowdown, the “E” in P/E (price over earnings) would drop a lot faster than other equity asset classes. But with our outlook for sustained economic strength in the macroeconomic picture, we think Small Caps continue to be attractive and worthy of an overweight position.

International Developed

International Developed economies headed into 2022 with increasing growth prospects. Eurozone business surveys were showing broad-based strength and rising optimism. The fiscal policy backdrop was accommodative as the EU recovery fund disbursements continued and Germany’s new government pursued a more supportive fiscal stance. Monetary policy remained accommodative, as the European Central Bank (ECB) was firmly dovish in its policy outlook. Comparing this to where the U.S. is from an overall perspective, the eurozone was (and remains) further behind in its climb out of COVID-19. We believed then and still do today that the economy and, likely, markets have further room to run than in the U.S.

Additionally, eurozone equity markets have relatively high exposure to financials and cyclically sensitive sectors such as industrials, materials and energy — areas that we believe are cheap and poised to move higher. The confluence of these economic and market factors led us to enter the year with a favorable outlook toward the region. However, this positive backdrop has now been met with a new reality of spiking gas and energy prices from the Ukraine-Russia war. This reality provides a significant headwind to eurozone economies, which has dragged the returns of these markets down significantly over the past few days.

The Japanese recovery remains even more lackluster, with consumption still below pre-COVID-19 levels. 2022 should see some acceleration in economic activity. Consumers are sitting on excess savings, and rising vaccination rates should encourage more mobility and spending. New Prime Minister Fumio Kishida announced a fiscal package of around 5.5 percent of GDP, which will flow through the economy in 2022. Unlike in other developed countries, inflation has remained very subdued in Japan due to softer demand and fewer challenges with supply chains. The Bank of Japan will likely lag other central banks in raising interest rates.

Over the past week the nearer-term international economic backdrop has been complicated by heightened geopolitical risk. While we continue to review our overall outlook, especially when it comes to our slight eurozone tilt, we believe the near 25 percent discount these markets retain to U.S. stocks provides an attractive valuation for intermediate-term investors, and as such, we retain our overall position at slightly overweight.

Emerging Markets

Despite Russia-Ukraine tensions dominating the headlines in the developing world, Emerging Markets stocks remain near the top of the heap of the best-performing equity asset class year to date. While we acknowledge concern that the Russia-Ukraine crisis will escalate further, Emerging Markets outperformance is painting a picture of China’s economic recovery continuing as recent stimulus takes hold, while commodity-producing and -exporting emerging economies advance strongly. Fox example, we note that through March 2, 2022, the MSCI Emerging Markets Latin America Index is up nearly 13 percent year to date.

China comprises about 40 percent of Emerging Markets. Here we note a few items that are potential positives for equity markets in China. First, China is in the process of revisiting the country’s COVID-zero policy. The new approach proposes to put “people and life first,” according to Wu Zunyou, chief epidemiologist at the Chinese Center for Disease Control and Prevention. The Peoples Bank of China policy has been mostly accommodative (versus contractionary in much of the developed world). And China Evergrande concerns have eased a bit while a restructuring is contemplated.

While it is not our base case, we must acknowledge that a more sustained, long-term increase in inflation is a possibility moving into mid- to late 2022. If this were to unfold, central banks in Emerging Markets would likely have to tighten monetary policy even further and yield a market headwind. However, there are countervailing tailwinds for Emerging Markets. These economies are sensitive to global growth and should benefit from a continued global economic recovery in 2022. Let’s not forget that many of the economies have been hit hard by COVID-19, and that pressure is currently being lifted.

Relative valuations are very attractive and currently sit at 20-year lows versus the developed world. As we look at Emerging Markets as a broad basket, they are expected to collectively grow at double the rate of the developed world over the next decade. Growth in these economies will be driven by an ascending middle class, the transition from manufacturing-based economies to services, and technology. Developing countries account for about 40 percent of world GDP and 25 percent of world equity markets, which means it’s important to have some exposure in a well-diversified portfolio.

When we look at this backdrop and account for future risks, we maintain our allocation at a slight overweight compared to our long-term strategic target.

Section 04 Fixed Income

Fixed Income investors have witnessed increased volatility over the past few months as markets first grappled with higher yields against an inflationary backdrop and then a near-term rally on a flight-to-safety trade from the Russia-Ukraine war. This resulted in the bond market’s barometer of volatility, the ICE Bank of America MOVE Index, spiking to 118.26. Outside the COVID-19 shock of March 2020, that represents the highest level since late 2010.

While we continue to see upward pressure on Treasury yields in 2022 as the Fed stops its quantitative easing (QE) program (buying $80 billion of U.S. Treasurys a month), we believe it is likely the yield advance pace slows as the Fed tightens policy and inflation moderates. Ultimately, the question of where long-term Treasury yields settle will be determined by prospects for future economic growth. If we are on the precipice of heightened intermediate- to long-term economic growth on the back of productivity advancements, then it is likely that the neutral interest rate has risen. This rise would translate to an economy that can handle additional rate hikes, with a potentially higher ceiling on long-term interest rates.

We recently cut our exposure to Treasury Inflation Protection Securities (TIPS) based upon our belief that inflationary pressures and expectations are set to subside. We remind that this is a position we recommended in August 2019, when five-year inflation expectations were near 1.3 percent, well below the Fed’s 2 percent target. This view proved prescient, as the US-China trade war moderated and inflation expectations rose only to be upended by COVID-19’s arrival in March 2020. We added to this position in early April 2020 with the same five-year breakeven rate checking in at 0.55 percent. In our April 2020 Asset Allocation Focus update, we expressed our belief that inflation, like the economy, would recover and further upgraded our TIPS outlook:

“We believe unprecedented fiscal and monetary stimulus, along with post-COVID-19 societal shifts, will eventually lead to higher inflation and higher interest rates. Given the reactionary function of capital markets over the past few weeks, the fixed-income market’s future inflation expectation has plunged. However, these actions may ultimately have intermediate- to long-term implications in the form of inflation. If future inflation is higher than current market expectations, TIPS should outperform their more traditional U.S. Nominal Treasury friends.”

Our forecast remains that inflationary expectations are set to wane; therefore, we have lowered our outlook on TIPS to neutral and returned our Fixed Income allocation toward coupon-paying investments.

Overall, we continue to position our duration near neutral and favor higher-quality fixed income. The last few weeks have provided a real-life example of why we continually implore investors to resist the urge to blindly hunt for yield or higher returns by cutting exposure to safer Fixed Income assets, especially in the context of an overall portfolio equity overweight. Simply put, every slice of the portfolio has a role to play, regardless of the market mood or economic environment. Don’t tear apart your portfolio based on short-term considerations. Fixed Income is not simply a vehicle for income generation but also one for risk mitigation.

Related Articles

Duration

In the December 2021 Asset Allocation Focus we expressed our belief that the yield curve would flatten as Fed rhetoric increased. Since that time the spread between 10-year Treasury yields and 2-year Treasury yields has fallen (the yield curve has flattened) by nearly 50 basis points. During the same time, the 2-year Treasury yield minus the Fed funds rate increased (steepened) by over 100 basis points. This tells us that the market has already discounted future Fed rate hikes.

The beginning of 2022 has proven to be a difficult backdrop for Fixed Income investors, not just on the longer end but even in the short to intermediate part of the yield curve. The 2-year is up more than 100 basis points since last writing, the 5-year up about 70 basis points and the 10-year up 30 basis points. Typically, when rates start to rise, the curve flattens. This flattening means total returns across the Treasury yield curve are all down 2 to 3 percent, no matter where you were positioned on the curve between the 2-year Treasury and the 10-year Treasury. Put differently, if you were “short duration,” you didn’t really save much, and now you need to make a move to capture higher rates as your short-duration securities have seasoned dramatically. Therefore, we continue to focus on high-quality duration can even when rates rise.

Government Securities

The U.S. dollar has been on a run since Q2 2021, and the recent geopolitical events have strengthened it. This strength is correlated to the recent yield curve flattening. With real rates extremely negative, this logic seems a bit counterintuitive, but we believe it likely foreshadows real rates becoming less negative as economic growth pushes forward and inflation moderates. We continue to express our desire to hold U.S. government securities versus their international counterparts, especially as geopolitical tensions rise.

Credit

With the dollar rising, real rates negative and talk of the Fed tightening all picking up, credit spreads continue widening. The messages from the yield curve, nominal rates, real rates and credit spreads seem somewhat inconsistent. We believe this reflects a chance that the future behavior of credit spreads could hinge on the performance of equity markets, not the other way around (as is typically the case). With rates so low in real terms, credit should be doing quite well, as inflation against a low nominal rate environment acts to reduce the debt service hurdle rates for marginal credits. With the potential for the Fed to be very active in 2022, coupled with the rise in geopolitical risk, we maintain our desire to have higher-quality Fixed Income exposure.

TIPS

Over the past few years, negative real rates have led to dramatic relative outperformance of TIPS. We believe inflation will fall in 2022, and the inverted TIPS break-even curve supports this view. This “TIPS inversion” has happened in the past, and each time it has foreshadowed falling inflation and TIPS underperforming. Keep any remaining TIPS exposure short duration. With the 1-year to 10-year TIPS breakeven spread around -130 basis points (as of this writing), the market believes the Fed will not let inflation get out of control.

Municipal Bonds

Municipal bond ratios are ever so cautiously starting to widen. This is mostly a result of the move in rates and has little to do with credit. As the ICE Bank of America MOVE index continues to increase (measure of implied Fixed Income volatility), investors will likely pay more for the optionality inherent in municipal bonds as well as other Fixed Income instruments with convexity, such as mortgage-backed securities and collateralized mortgage obligations. While these instruments are more susceptible to incremental moves of implied volatility, municipal bonds can also partake in the moves should they become more substantial.

Section 05 Real Assets

Over the past year, this document has contained insight into the potential inflationary impacts of COVID-19. For the first time in more than a decade, investors are now actively discussing inflation as a lasting feature of the economy. We believe real assets can continue to perform well in such an environment.

We have also discussed the ability of real assets, such as Commodities, to do well when in other asset classes, such as bonds and stocks, returns are moving lower. Add in an “occasional” reminder that geopolitical events oftentimes coincide with increases in energy prices, and all the reasons we recommend owning commodities are now coming to fruition. Longer term, we believe this recent market action shows why we still believe that Commodities remain an important diversification tool for portfolio construction.

Within Commodities, we continue to favor broad exposure with a tilt toward gold given our desire to further diversify our portfolios and hedge against unintended consequences of geopolitical uncertainty. While we remain relatively optimistic about the future, certainly there are risks, and we believe additional exposure to gold provides added diversification benefits.

REITs were initially the post-COVID-19 laggards when investors contemplated and repriced the intermediate- to long-term impacts from the pandemic. As we progressed through 2021 and the U.S. economy adapted to COVID-19, REITs surged to the top of the performance heap. However, for the past few months the relative performance of REITs has paused as real yields have risen on the back of Fed rate hike fears. We note that we would likely contemplate increasing our REIT exposure if its relative performance continued to suffer.

Real Estate

We have noted in the past that REITs commonly pay higher dividends than other equity securities. Even today, the dividend spread between many REIT indexes and large-cap equities is close to 100 basis points. This differential is likely to persist and make REITs attractive income-producing assets throughout 2022. Additionally, valuation levels between the earnings multiples of U.S. equities and U.S. REITs are expected to remain attractive, and we may view any pullback in the future as a potential buying opportunity. If inflation proves to be more persistent than expected, Real Estate can be a crucial portfolio hedge against increasing price levels throughout the economy. Even in the face of a rising interest rate environment, we believe REITs offer attractive return and diversification benefits in our portfolios. We will continue to monitor the REIT market for opportunities to adjust our exposure.

Commodities

Commodity prices continue to post big gains this year in response to a range of factors, including rising U.S. inflation data, supply-chain bottlenecks, strong economic growth and now the Ukraine-Russia war. Through March 8, commodity prices have already risen 37 percent year to date, following a strong 27.1 percent gain in 2021. Moreover, after this recent surge, Commodities have now dramatically outperformed all equity markets we track since the onset of COVID in early 2020.

As we look forward, our forecast is for global demand for Commodities to remain strong into mid-2022. Throw in the potential for Russian and Ukrainian supply disruptions, and one has a strong near-term outlook for rising commodity prices.

While we have a positive outlook for commodity returns, our inflation outlook would suggest the current rate of appreciation isn’t sustainable. Over the past seven months, inflation has surged to levels not seen since the 1980s, but that’s also the era when inflation began a consistent push lower and eventually fueled the last economic cycle’s deflationary worries that engulfed markets. The return of inflation has sparked a fierce debate in markets. Are we in a new inflationary regime, or is this a pandemic-fueled distortion?

We do not believe we are in a new inflationary era. When you dig deeper than headlines about inflation, you find it’s largely been fueled by unsustainable durable goods spending. We believe durables spending will normalize and pull headline inflation lower with it. Data indicate that a shift in spending is already underway, as services spending markedly increased in Q3 while overall goods spending declined.

Precious Metals have responded positively in 2022, gaining 9 percent year to date, as gold prices have gained on the back of rising geopolitical risk. Gold serves as a haven for investors, particularly in an environment with negative real (inflation-adjusted) interest rates. We would have expected gold prices to rise higher in 2021 as inflation expectations rose and interest rates declined. The long-term relationship between gold and real rates is valid, but there have been sustained short-term periods when the linkage has been inconsistent. That said, we find no reason to abandon the anchoring of gold to real yields and continue to expect gold to provide us a hedge against unforeseen economic outcomes.

Many would suggest that Bitcoin may be attracting flows from traditional gold due to it being dubbed Gold 2.0. Perhaps, but we note that it has acted very sporadically — less like a haven and more like a risk asset. Recent sanctions on Russia have led Bitcoin higher, as it has provided a pathway around sanctions. While some may suggest this validates the asset class as a haven, we believe it will only serve to place it more firmly in the regulatory crosshairs.

The three primary components of the Bloomberg Commodity Index are energy, metals (both industrial and precious) and agriculture. The benchmark is composed of around a third of each sector, which means that the benchmark is broadly diversified across the Commodities spectrum and ensures that no single commodity has an outsized impact on overall risk and return. The individual components of the Commodity benchmark have unique characteristics and prices that are determined by different supply and demand drivers within individual markets. However, inflation, economic growth and the direction of the U.S. dollar are the largest drivers for overall commodity prices.

Section 06 Bottom Line: Tune Out the Stream of Negativity

Investors are often barraged with a heightened stream of news that leaves them confused. After all, how does one process so much information and figure out what to make of it? This reality likely leads them to believe that they should act and do something, which all too often pushes them to sell and “concentrate” in cash.

While this document provides insights on how we filter this information through our investment process to make sense of it, the reality is that there is a starting point, or anchor, that we begin from. Think of this as the starting allocation we use to guide our clients through the good times and the bad times to help them fulfill their financial and life goals and objectives. Our starting allocation is the path that we recommend our clients take, on average, every single day (when markets are in equilibrium or moving toward equilibrium) to get them to their end destination.

Obviously, markets aren’t always in equilibrium. Shocks like COVID-19 and wars hit, and markets sell off, creating opportunities for those able and willing to accept risk. This document provides a big-picture lens into the variables we look at to build a mosaic on asset class winners, the economy, monetary and fiscal policy outlook, relative valuations and market sentiment or structure. Think of the tilts (overweights and underweights) that we describe in this document as temporary movements around traffic jams on the longer-term path, with a goal of getting our clients to the end destination just a bit more quickly and comfortably.

Let us use the above framework to add some commentary that should help ease any stress the current environment is providing. Our research provides historical detail on different asset allocations and their performance over varying time frames over the past 45 years. Notice how a 60/40 portfolio has had only three negative five-year rolling returns during this time. Think about that in the context of all the events, shocks and economic environments that have happened during this time. Contemplate that all three of these occurred during five-year time periods that ended at the peak of the Great Financial Crisis in 2009. Recall that was only the second recession in this country that acquired the adjective GREAT, other than the Great Depression of the late 1920s. If you have a longer time horizon, perhaps you can accept more equity risk to garner more returns. This is the base from which we encourage you to put all of the recent worries into context.

In the December 2021 Asset Allocation Focus we discussed that a 60/40 portfolio wasn’t dead; rather, it needed an upgrade. We posited that Commodities were a third asset class that could help forward returns and that the 60 percent needed to have other equity flavors, such as small caps and international securities, added to it. These realities are currently playing out.

Planning for uncertainly is at the core of Northwestern Mutual’s philosophy. Our advisors plan for not only the good times but also the bad times. Our investment philosophy builds upon that and emphasizes diversification. Importantly, we believe a properly diversified portfolio includes commodities, gold and even long-term Treasurys that many prior to the recent geopolitical risk wanted to avoid.

While many profess that they believe diversification is a good thing, once they get it, they don’t love it because it means that something they own isn’t working. That is not a flaw but a design feature. This helps protect against events that are, frankly, unpredictable. No one knows for certain what will happen in markets or in life. Think about this when you are tempted to pull apart your portfolio and judge each asset class individually based upon its own merits or what it has done for you lately. We don’t think of asset classes as bad or good but, instead, in the context of what risk they help address vs. their potential for future returns. The world is unpredictable; we acknowledge that, and it’s why we believe a properly constructed portfolio via a financial plan is necessary to address that.

Brent Schutte, CFA®, Chief Investment Strategist

Michael Helmuth, Chief Portfolio Manager, Fixed Income

Richard Iwanski, CFA®, CAIA, Senior Research & Portfolio Analyst

Matthew Wilbur, Senior Director, Advisory Investments

Matthew Stucky, CFA®, Senior Portfolio Manager, Equities

Doug Peck, CFA®, Portfolio Manager, Private Client Services

David Humphreys, CFA®, Senior Investment Consultant

Nicolas Brown, CFA®, CAIA, Senior Research Analyst, NMWMC Research

The opinions expressed are those of Northwestern Mutual Wealth Management Company as of the date stated on this material and are subject to change. There is no guarantee that the forecasts made will come to pass. This material does not constitute individual investor advice and is not intended as an endorsement of any specific investment or security. Information and opinions are derived from proprietary and non-proprietary sources.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NM), Milwaukee, WI, and its subsidiaries. Investment brokerage services are offered through Northwestern Mutual Investment Services, LLC (NMIS), a subsidiary of NM, broker-dealer, registered investment adviser, and member FINRA and SIPC. Investment advisory and trust services are offered through Northwestern Mutual Wealth Management Company® (NMWMC), Milwaukee, WI, a subsidiary of NM and a federal savings bank. Products and services referenced are offered and sold only by appropriately appointed and licensed entities and financial advisors and professionals. Not all products and services are available in all states. Not all Northwestern Mutual representatives are advisors. Only those representatives with “Advisor” in their title or who otherwise disclose their status as an advisor of NMWMC are credentialed as NMWMC representatives to provide investment advisory services.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. Indexes and/or benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance and are not indicative of any specific investment. Diversification and strategic asset allocation do not assure profit or protect against loss.

Although stocks have historically outperformed bonds, they also have historically been more volatile. Investors should carefully consider their ability to invest during volatile periods in the market.

With fixed income securities and bonds, when interest rates rise, bond prices usually fall because an investor may earn a higher yield with another bond. Moreover, the longer the maturity of a bond, the greater the risk. When interest rates are at low levels, there is a risk that a significant rise in interest rates can occur in a short period of time and cause losses to the market value of any bonds that you own. At maturity, the issuer of the bond is obligated to return the principal (original investment) to the investor. High-yield bonds present greater credit risk than bonds of higher quality. Bond investors should carefully consider risks such as interest rate risk, credit risk, liquidity risk, securities lending risk, repurchase and reverse repurchase transaction risk.

Investing in special sectors, such as real estate, can be subject to different and greater risks than more diversified investing and may present more financial and other risks than investing in companies of larger capitalizations and more seasoned companies. Declines in the value of real estate, economic conditions, property taxes, tax laws and interest rates all present potential risks to real estate investments.

Investing in real estate companies entails some of the risks associated with investing in real estate directly, including sensitivity to general and local economic and market conditions, demographic patterns, changes in interest rates and governmental actions.

Investors should be aware of the risks of investments in foreign securities, particularly investments in securities of companies in developing nations. These include the risks of currency fluctuation, of political and economic instability and of less well-developed government supervision and regulation of business and industry practices, as well as differences in accounting standards.

Commodity prices fluctuate more than other asset prices, with the potential for large losses, and may be affected by market events, weather, regulatory or political developments, worldwide competition and economic conditions. Investment can be made directly in physical assets or commodity-linked derivative instruments, such as commodity swap agreements or futures contracts.

Treasury Inflation-Protected Securities (TIPS) are securities indexed to inflation in order to protect investors from the negative effects of inflation.

The U.S. Large Cap asset class is measured by the S&P 500 Index, which is a capitalization weighted index of 500 stocks. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The gross domestic product (GDP) is the amount of goods and services produced in a year in a country.

The U.S. Mid Cap asset class is measured by the S&P MidCap 400 Index, which is the most widely used index for mid-sized companies and covers approximately 7 percent of the U.S. equities market.

The U.S. Small Cap asset class is measured by the S&P Small Cap 600 Index, a market value weighted index that consists of 600 small-cap U.S. stocks chosen for market size, liquidity and industry group representation.

The International Developed Markets asset class is measured by the Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index, which is composed of all the publicly traded stocks in developed non-U.S. markets. The MSCI EAFE Index consists of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

The International Emerging Markets asset class is measured by the MSCI Emerging Markets Index, which is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 21 emerging-market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

The Real Estate asset class is measured by the Dow Jones U.S. Select REIT Index, which intends to measure the performance of publicly traded REITs and REIT-like securities. The index is a subset of the Dow Jones U.S. Select Real Estate Securities Index (RESI), which represents equity real estate investment trusts (REITs) and real estate operating companies (REOCs) traded in the U.S. The indices are designed to serve as proxies for direct real estate investment, in part by excluding companies whose performance may be driven by factors other than the value of real estate.

The Commodities asset class is measured by the Bloomberg Commodity Index (BCOM), formerly the Dow Jones-UBS Commodity Index, which is a highly liquid, diversified and transparent benchmark for the global commodities market. It is calculated on an excess return basis and reflects commodity futures price movements.

The Consumer Price Index (CPI) examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care.