guide

How Much Do I Need to Retire?

Read the guide

No matter what you see yourself doing or the places you picture yourself exploring when 9–5 is all yours, we can help you plan for it.

Start planningAt Northwestern Mutual, we'll help you find the right tax-efficient financial strategies you'll need to help you retire the way you want. From 401(k)s, IRAs, investments and annuities to the right types of insurance, we'll help you maximize your savings, build more wealth, create a guaranteed income stream, and protect you from the unexpected. That way, you can make the most of your retirement while still enjoying your life today.

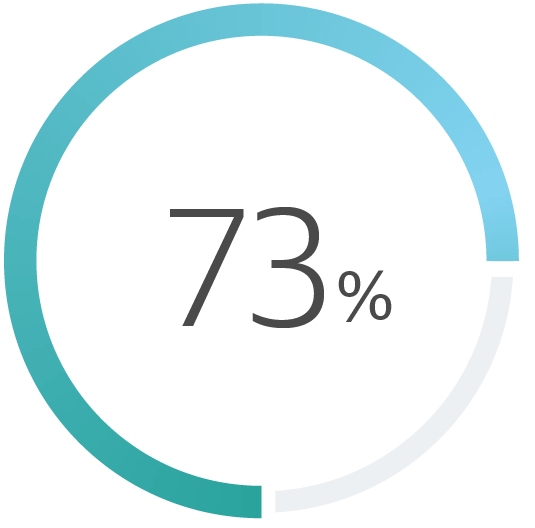

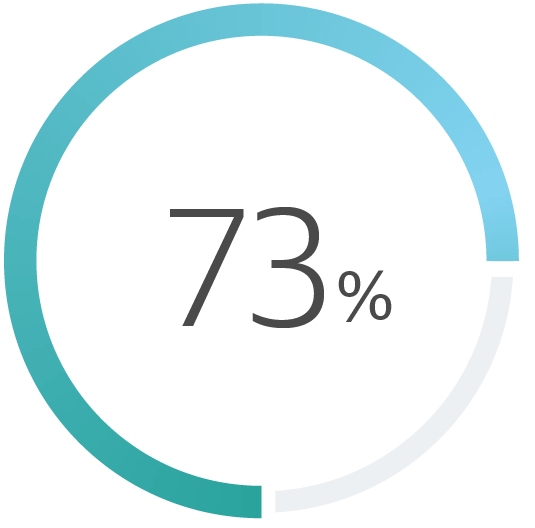

of Americans who work with an advisor say they have clarity on how much to spend now and save for later.1

of Americans who work with an advisor say they have clarity on how much to spend now and save for later.1

Our financial advisors will help you make the most of your money, no matter how much you have, with a plan tailored to you and your retirement goals.

We'll design a plan to help mitigate financial risk and create the right amount of income so you can have the retirement you always dreamed of.

We're expert listeners and our conversations will be free of any jargon or judgment. No matter what your situation is, we're here to show you the right financial steps to take.

At Northwestern Mutual, we see a retirement plan as just one part of a comprehensive financial plan. Our advisors will look at every aspect of your life and listen to all of your goals. Once they have your big picture in focus, they'll bring together multiple financial strategies that include investments and life insurance to create a tailored plan that's designed to help you:

$9.2B in dividends expected to be paid in 2026

in dividends expected to be paid in 20263

Top 10 ranked investment service

We're one of the top U.S. Independent Investment Broker-Dealers.4

The percentage of our policyowners who stay with us year over year.5

Watch the video

Our advisors will design your retirement plan based on your priorities and goals. Tailored from a wide range of financial options, including investment and insurance strategies, you'll feel more confident that you can retire when you want, the way you want.

It's easy to get started—no commitment, just a better conversation.